JobKeeper 2.0 extends Australia’s unprecedented economic stimulus and job support package for another six months.

All the technical changes passed through Parliament earlier this week. We give you an easy to digest low down on what the changes are and what you need to do.

This Article Covers

· Details of the JobKeeper extension

· What are the catches if you are eligible

· What to do if you are not going to be eligible

· What to communicate to staff

· Where to find help

What is the JobKeeper Extension?

JobKeeper is a wage subsidy introduced in March 2020 to support businesses significantly affected by the COVID-19 pandemic to help keep more Australians in jobs.

To qualify for JobKeeper, you have needed to show that you have experienced the requisite downturn in business turnover and only certain employees have been eligible for the payments. JobKeeper payments are administered by the Australian Taxation Office and were scheduled to end on 27 September 2020.

The Federal Government recently announced the extension of JobKeeper payments to eligible employers to 28 March 2021. However, the payments will be targetted towards the Australian businesses and not-for-profits which continue to be significantly impacted by the Coronavirus.

This means that from 28 September 2020 there will be changes to the eligibility requirements.

So, What is the New Test?

To be eligible for JobKeeper payments from 28 September 2020, the test remains the same. You must still show:

· a 30% reduction of turnover (so long as your turnover is less than 1 billion); or

· a 15% reduction of turnover if you are a registered charity.

However, your reduction must be actual (rather than projected) which is a significant change from the current JobKeeper regime.

To be eligible for JobKeeper payments from 28 September 2020 to 3 January 2021, you must meet the test in this quarter (ie the September quarter).

To be eligible for JobKeeper payments from 3 January 2021 to 28 March 2021, you must meet the test in the next quarter (ie the December quarter).

The JobKeeper payments will continue to remain open to new recipients so if your eligibility has changed or changes in the next quarter, you can still apply.

Who is Covered?

More employees are now eligible for JobKeeper. You can now claim payments for employees who you currently employ that are either:

· a full-time, part-time or fixed-term employee at 1 July 2020; or

· a long-term casual employee (employed on a regular and systematic basis for at least 12 months) as at 1 July 2020 and not a permanent employee of any other employer.

These employees must now also be:

· 18 years or older at 1 July 2020 (if you were 16 or 17 you can also qualify if you are independent or not undertaking full time study);

· either:

o an Australian resident (within the meaning of the Social Security Act 1991); or

o an Australian resident for the purpose of the Income Tax Assessment Act 1936 and the holder of a Subclass 444 (Special Category) visa as at 1 July 2020; and

· not in receipt of any of these payments during the JobKeeper fortnight:

o government parental leave or Dad and partner pay under the Paid Parental Leave Act 2010; or

o a payment in accordance with Australian worker compensation law for an individual’s total incapacity for work.

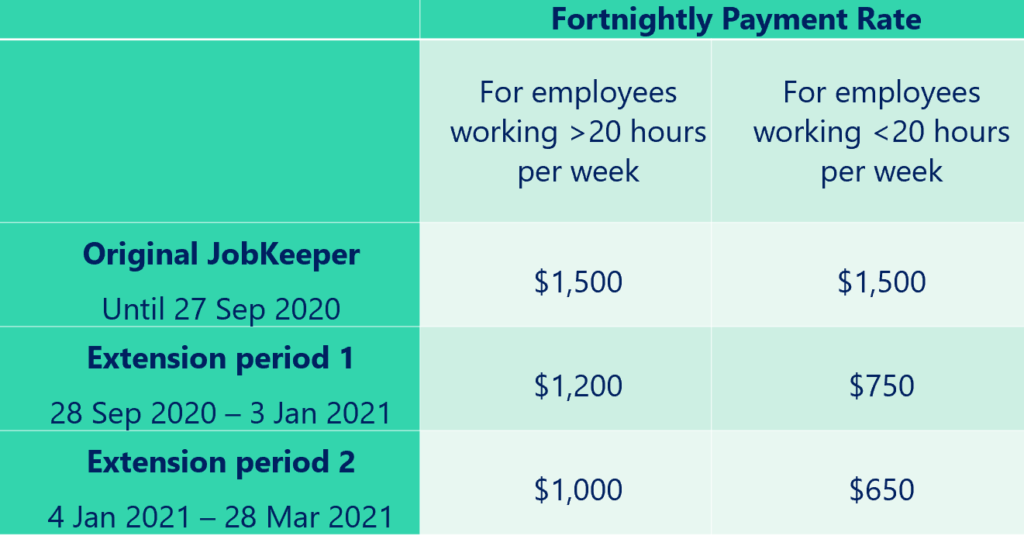

How Much will I Get?

I think I’ll be Eligible. What are the Catches?

If you will be eligible for JobKeeper from 28 September 2020, there are some really important things you need to think about and decide.

You will still need to be able to pay your employees upfront. This could cause some cash flow issues for your business.

Accordingly, you need to be asking yourself:

- Do the numbers still work?

- Can you afford to keep all of your staff now or for the foreseeable future?

- Will you have enough for your staff to do?

- If your staff are working, can you still afford to be giving them all the same hours?

- Or, if you have staff that are not working, do you see yourself having a role for those staff in the foreseeable future?

If the numbers are not going to work for you, you have a number of options.

I’m Not Going to be Eligible. Now What?

If you are not eligible for JobKeeper, but have experienced a downturn in turnover, there are also some really important questions for you to think about and decide.

But don’t worry too much yet. You have a number of different levers that you can pull up or down over the coming months to help steer your business through this pandemic (You can find out more about each of these levers in this article we prepared earlier in the pandemic).

With the right strategy, you can survive and then thrive these uncertain times.

Your strategy will depend on how your business is performing at the moment. This includes sales performance, productivity, staff health and wellbeing and your cash flow.

Ask yourself:

- What have you got coming in versus going out?

- What are your business needs right now?

- Is your headcount and resourcing aligned with the needs and priorities of your business?

- Do you need to reduce head count or staffing costs?

- Or, can you wear/carry a costs centre for a bit longer?

- If so, exactly how much longer?

If you were previously eligible for JobKeeper, you will also be able to access the temporary JobKeeper powers to stand down or partially stand down staff, and change their working hours, days and location as a “legacy employer”. You will only be able to do this if you hold a certificate from an eligible financial service stating that you have experienced a 10% decline in the quarter.

You will also not be able to use a JobKeeper power to direct an employee to work less than 60% of their pre-COVID hours and require an employee to work less than 2 hours a day.

There are fines for misuse of the powers. Penalties include up to $13,200 for individuals and $66,600 for employers. Click here for our JobKeeper Handbook which has 12 template documents and access to an hour of consulting advice.

Notwithstanding the new powers above, you should attempt to obtain agreement from your employees for any changes to their duties or their work location before resorting to a direction as it’s always preferable.

You should also keep in mind that the powers are only temporary and you may need to consider a shorter or longer timeframe for any staffing changes to give you greater flexibility in your workforce planning, and/or an opportunity to review the arrangements in case you decide you want to extend the arrangements beyond the JobKeeper payments or the pandemic.

If you are directing staffing changes or issuing stand down order, we strongly recommend that you give us a call to discuss, and if necessary obtain further specialised advice.

Managing My Obligations

Be aware of the general Fair Work Act 2009 entitlements and requirements as well as any specific requirements under your enterprise bargaining agreement (EBA) or employment contracts.

An option which seems like the more efficient and cheaper option now, could end up being an expensive and painful option either in the short-term or down the track if it is not implemented well.

With the job market not great at the moment, disgruntled employees may issue proceedings seeking reinstatement, compensation or unpaid entitlements, and it is unclear how the Fair Work Commission will treat these cases in our unprecedented times.

We have a FREE Restructure and Redundancy “How-to” Guide you can download here and packs of resources and templates for you to access. Check out our Restructure and Redundancy pack and our Guide to avoiding unfair dismissal.

Communicating with Staff

You will need to think about what to say to staff if whether you remain eligible for JobKeeper or not. What you can say will of course depend on what you know and what you have planned.

However, it important to keep your staff as informed and engaged as possible – not only for team morale but also for productivity. An uncertain or confused team is not going to perform as well as a team that understands where they stand.

You may only be able to tell them that you are currently reviewing your operations and how you will respond to where we are now. But it’s important to give them timeframes for decision making and details of the process.

Do you have your key messages and a communications plan ready?

If you will remain eligible for JobKeeper, what will you say to staff about the reduced payments? Some might be disgruntled. Others will be looking for more shifts to top them up. Can you afford to top up their wages and/or offer more shifts?

Are all of your managers briefed and trained in communicating with your staff during this difficult time?

For more information on managing your team during this time, read our articles on how to communicate with staff during a health crisis and managing workplaces during COVID-19.

If you need any support in this area, get in touch and we’ll coach you through it.

Where can I Find Help

We are currently advising many clients across all industries in relation to the challenges they are facing during COVID-19 and in particular the impact of the end of JobKeeper 1.0.

We are also regularly updating our publications on the Australian governments’ response to the pandemic.

If you need any support in this area, get in touch and we’ll support you through it.

For specialist assistance, please contact Susanna Ritchie on 0407 843 130 or susanna@workplacewizards.com.au.

Comments are closed.